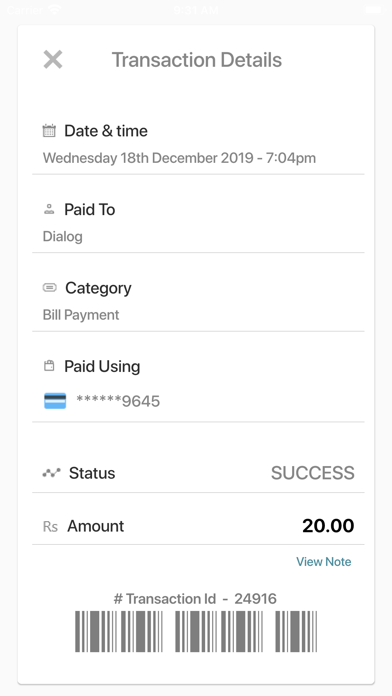

This solution facilitates account to account transactions between the merchant and the customer using a quick reference code masking the real account. If both the merchant and the customer are of the same bank to provide it will perform an account to account fund transfer. If they are in different banks, transactions will be facilitated through LankaPay.

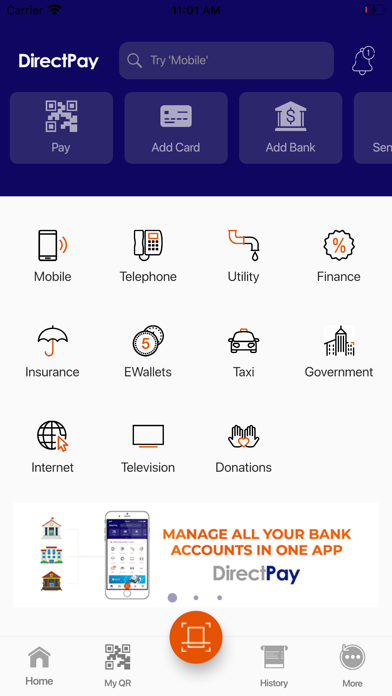

DirectPay brings users numerous benefits including ease of access and reduction in transaction time and cost. Whenever the user is required to make a payment to the merchant the user can complete their transaction by just scanning the merchant’s QR code by the processing in the mobile application. We satisfy the need of financial transactions being made without going outside Sri Lanka for authorization purposes and to facilitate payments without the use of any 3rd party equipment.

Basically what happens in the app is that the Merchants have a QR code masking their information displayed at their shops. The users simply have to scan this QR code and enter the amount to be paid and proceed so that when the transaction is completed the merchant will receive a text message from the bank confirming the payments and the user will also receive a text message from the bank of the payment being completed through an account to account transfer between the merchant bank and the user’s bank only if both these parties are of the same bank.

This application provides maximum security to its users. At the time of registration on the DirectPay app, the user is required to enter the account number of the primary account and the phone number that is pre-registered with the bank. When the mobile number is entered, the application would grasp the IMEI number so that the user will not be able to use a separate phone to use this application. If the mobile is lost, another SIM card cannot be used to access our application. If the user has to change the number, he should contact the bank and initially change the mobile number in the bank’s database. There are basically two security features, the first is the password for the application when logging into the app and the second is the mobile IMEI number. For application registration, device change or SIM change there is a separate process to verify and authorize.